Source

Taken from an IBM® Redpaper™ publication featuring a case study that involves a fictitious company called JKHL Enterprises (JKHLE). The focus is on the Core Banking and Customer Care and Insight aspects of banking.

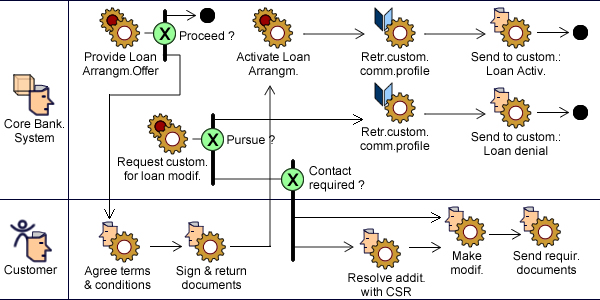

The objective is to migrate a traditional implementation of the business process to a service oriented one. For that purpose contributing activities are revisited and mapped to functional stereotypes.

Current business processes

Customer initiates contact with bank:

Some activities can already be stereotyped as interactions with agents (clerks or customers), computations, or access to data stores. Others mix decisions with computation and require more analysis.

Customer chooses a product or service:

The selection is set by loan type and doesn’t call for a decision.

Customer submits request, bank approves or rejects

A new activity must be introduced in order to explicitly represent the decision made par the approval department.

Loan arrangement is activated

Proposed business process

Customer initiates contact with the bank

Customer chooses a product or service

Customer submits request, bank approves or rejects

Loan Arrangement is Activated

Further Reading

- Thread: Enterprise Architecture

- Enterprise Architectures & Separation of Concerns

- Where to Begin with EA

- EA: The Matter of Layers

- EA: Maps & Territories

- EA: Work Units & Workflows

- Focus: Enterprise Architect Booklet

- Ontologies & Enterprise Architecture

- EA Frameworks: Non Negotiable Features

- Enterprise Governance & Knowledge

- Squaring EA Governance

- Focus: Enterprise Architect Booklet

External Links

- Introduction to IBM Industry Models

- IBM Information Framework model overview

- IBM Information Framework For the Banking Industry